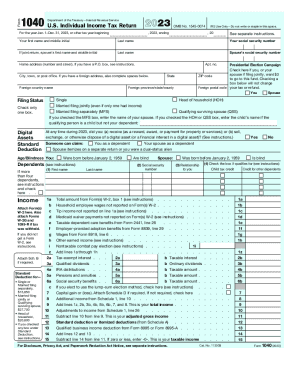

What are Schedules M-1 and M-2?

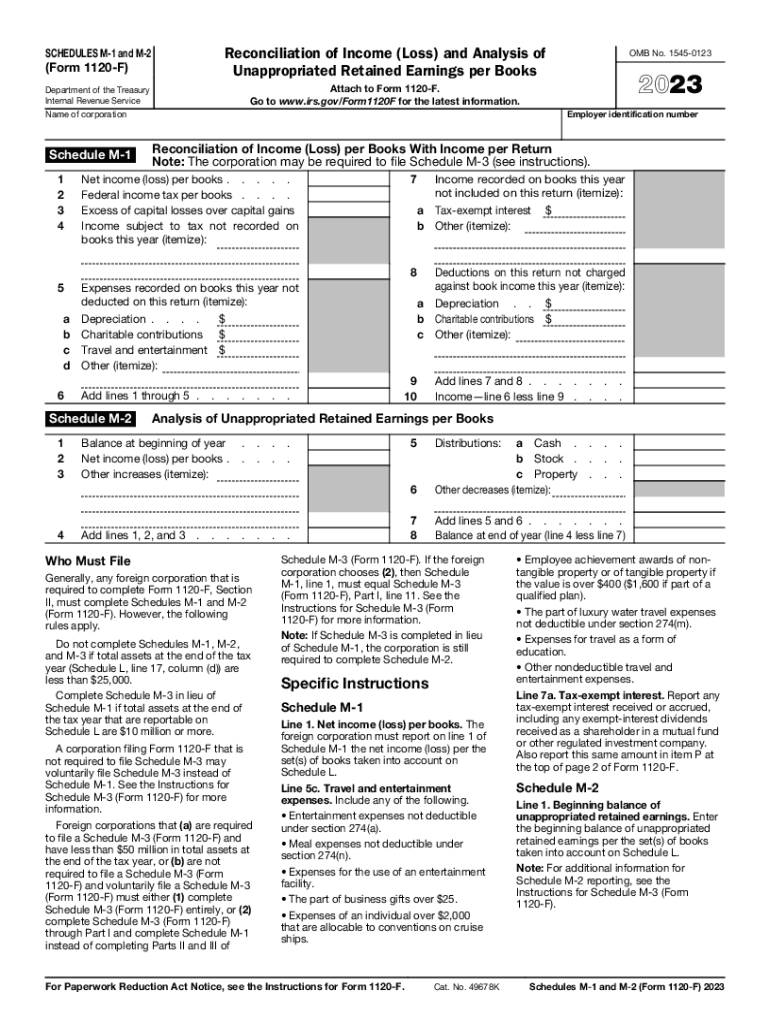

M-1 Schedule and M-2 Schedule are supplementary documents that accompany Form 1120-F. Foreign corporations file them to clarify additional details about reconciling income (loss) per books with income per return and analyzing unappropriated retained earnings per books.

Who should file M-1 and M-2 Schedules?

In general, any foreign corporation that submits Section II in the 1120-F form must submit Schedule M1 along with M2. However, there are some additional rules:

- Corporations whose total assets at the end of the year are less than $25,000 are not required to file these forms

- If total assets reportable on Schedule L are $10,000,000 or more, Schedule M-3 must be prepared in place of M 1

- Organizations that are not required to file M-3 can voluntarily file it instead of M 1

What information do I need to file Schedules M-1 and M-2?

The M 1 template requires filers to have detailed information about net income/loss, federal tax, expenses, contributions, and other payments.

M 2 requests information about unappropriated retained earnings: balance at the beginning of 2023, incomes, other increases, and distributions in stock, cash, and property.

How do I fill out M-1 and M-2 Schedules in 2024?

First, fill out your 1120-F form and prepare the detailed information mentioned above. Then, click Get Form at the top of the page and follow the guidelines below to fill out this one-page fillable template:

- Insert the corporation's name and Employer Identification Number into fillable fields at the top of the first page.

- Fill out Schedule M 1: provide information about net income, federal taxes, expenses, deduction, and other requested information in fillable fields.

- Fill out Schedule M 2: enter your balance at the beginning of the year, net income/loss, itemize other increases and decreases, indicate distributions, and balance at the end of 2023.

- Click Done to close the filler.

- Select Save As and export your document in your preferred format.

Are M-1 / M-2 Schedule accompanied by other forms?

These records cannot be filed separately; they must accompany the 1120-F form.

When are Schedules M-1 and M-2 (1120-А) due?

The due date for these attachments is the 15th day of the 4th month (April 15th). However, the deadline can be moved to the first available business day if it falls on a weekend or holiday.

Where do I send M-1 and M-2 Schedules (1120-F)?

Submit the records attached to your 1120-F to the Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409.