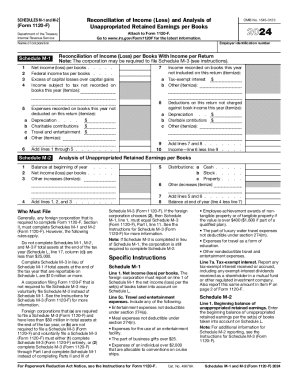

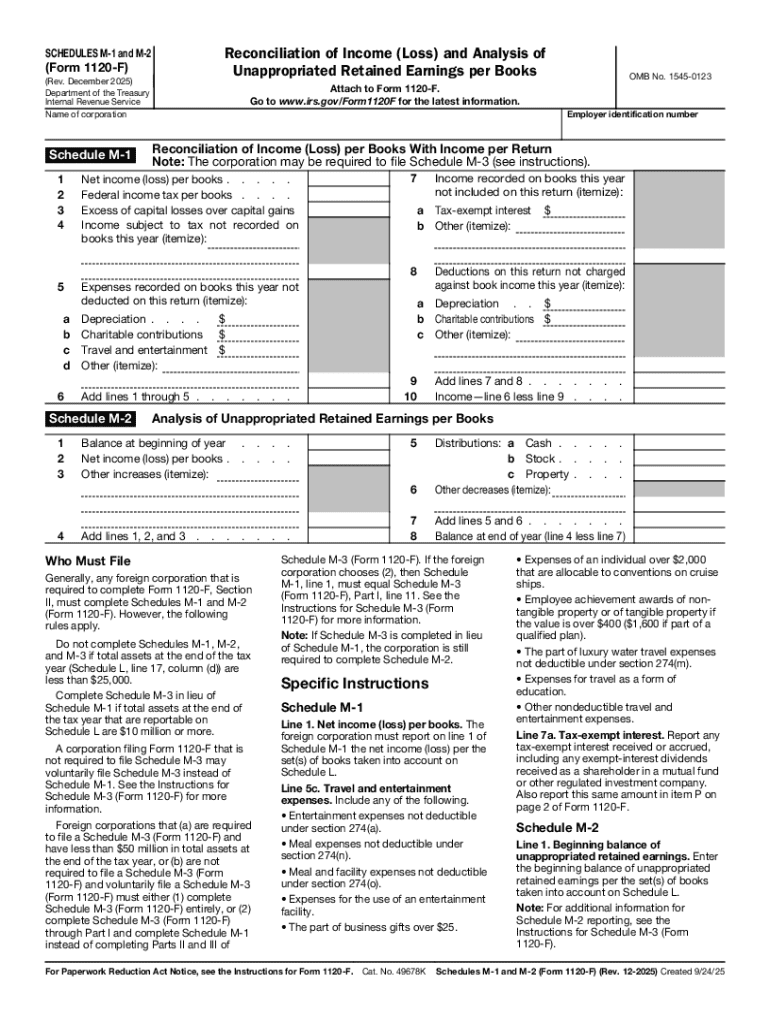

IRS 1120-F - Schedule M-1 & M-2 2025-2026 free printable template

Instructions and Help about IRS 1120-F - Schedule M-1 M-2

How to edit IRS 1120-F - Schedule M-1 M-2

How to fill out IRS 1120-F - Schedule M-1 M-2

Latest updates to IRS 1120-F - Schedule M-1 M-2

All You Need to Know About IRS 1120-F - Schedule M-1 M-2

What is IRS 1120-F - Schedule M-1 M-2?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120-F - Schedule M-1 M-2

What should I do if I discover an error after filing my IRS 1120-F - Schedule M-1 M-2?

If you notice an error after submitting your IRS 1120-F - Schedule M-1 M-2, you can correct it by filing an amended return. Use the appropriate form to indicate the changes and make sure to follow IRS guidelines for filing corrections to previously submitted forms.

How can I verify if the IRS has received my IRS 1120-F - Schedule M-1 M-2?

To verify the receipt of your IRS 1120-F - Schedule M-1 M-2, you can check the IRS's online portal or contact their support for updates. Keep in mind that processing times can vary, so it may take a few weeks for confirmation.

What are some common errors to avoid when filing IRS 1120-F - Schedule M-1 M-2?

Common errors when completing the IRS 1120-F - Schedule M-1 M-2 include incorrect calculations, missing signatures, and failing to adhere to filing instructions. Carefully reviewing your entries and ensuring accuracy before submission can help prevent these issues.

What should I do if my IRS 1120-F - Schedule M-1 M-2 is rejected during the e-filing process?

If your IRS 1120-F - Schedule M-1 M-2 is rejected, review the rejection code provided and correct the issues indicated. After making the necessary changes, resubmit your form following the prescribed e-filing procedures to ensure proper acceptance.

Are electronic signatures acceptable when filing IRS 1120-F - Schedule M-1 M-2?

Yes, electronic signatures are generally acceptable for IRS 1120-F - Schedule M-1 M-2 submissions, provided you meet the specific IRS requirements for e-signatures. Ensure that your e-filing software complies with these standards to avoid issues with your submission.